Emergency Fund: Financial First Aid

Hi friends,

Sod’s law says that if something can go wrong it will go wrong. I don’t know who the Sod was that made that statement but when we look across our own life, and the people we know, it can be pretty accurate.

Last week I spoke about the power of ISAs particularly in reference to Stock & Shares ISAs and how a little money can set you up for a super financial future. This week I want to talk about our lives today and how we can prepare ourself for the unexpected costs life throws up via an emergency fund. I will answer:

Who needs one

What they’re for

Why you need one

How much you need

Where to keep it

Look out for the poll at the end!

Who needs an emergency fund?

You. Well you probably do unless somehow have zero expenses and responsibilities in your life.

An emergency fund is an essential tool to help keep us financially fit and should come before any other saving or investing goals. It is necessary for anyone with any financial responsibility or obligation ranging from large things like rent or mortgage payments to smaller things like phone bills.

What is an emergency fund for?

Life has a funny way of throwing up surprising ways to make us spend our money on things we don’t really want to. An emergency fund is designed to cushion or even remove the blow from these unexpected expenses. It’s a pot of cash that is set aside only to be used to pay for these unexpected expenses.

For most of us the way we pay for our life is through our job. What if this job was to suddenly go with short notice? The average length of time to secure a job from starting the application process to accepting a job offer is just under 28 days. Do you know how you would pay for next month’s bills?

Now losing our job is quite extreme and thankfully doesn’t happen very often. But there is an endless list of things that could break that are quite essential to live our day-to-day life like washing machines, mobile phones or a car.

An emergency fund is not only there to support you when life happens, but it gives you confidence that you can overcome the financial challenges of life.

It supports you to pay for unexpected things that have broken and to keep paying your bills on time without forcing you to go into debt or drastically alter your life. It also provides peace of mind in the months you don’t need it. You can live your life in the knowledge that despite any unexpected financial challenges thrown your way you will have a buffer.

Why do I need an emergency fund?

Over 11 million of us in the UK have less than £1,000 in savings. I know how hard it can be to save as life throws so many different priorities at us. But that is why an emergency fund is so important. Any one of us can be blindsided by a random event that could push back our financial goals or severely impact our day-to-day lives.

It’s easy and reassuring to just think “these things won’t happen to me”. However, this thinking is misplaced and is more like sticking your head in the sand to avoid the realities of life. Without having money set aside to resolve these situations can lead you to go into debt.

Think about all the bills and payments you pay out of your bank account every month. If your job stops paying you tomorrow how are you dealing with that?

Let’s work through an example.

Your car is making a funny noise, you take it to a garage, and the mechanic says it will cost £650 to fix. For a lot of people being without a car means they can’t go to their place of work or education and can’t live their normal lives. This means you need to pay the £650.

If you don’t have an emergency fund, using a credit card may seem like a good answer as you can pay for it monthly.

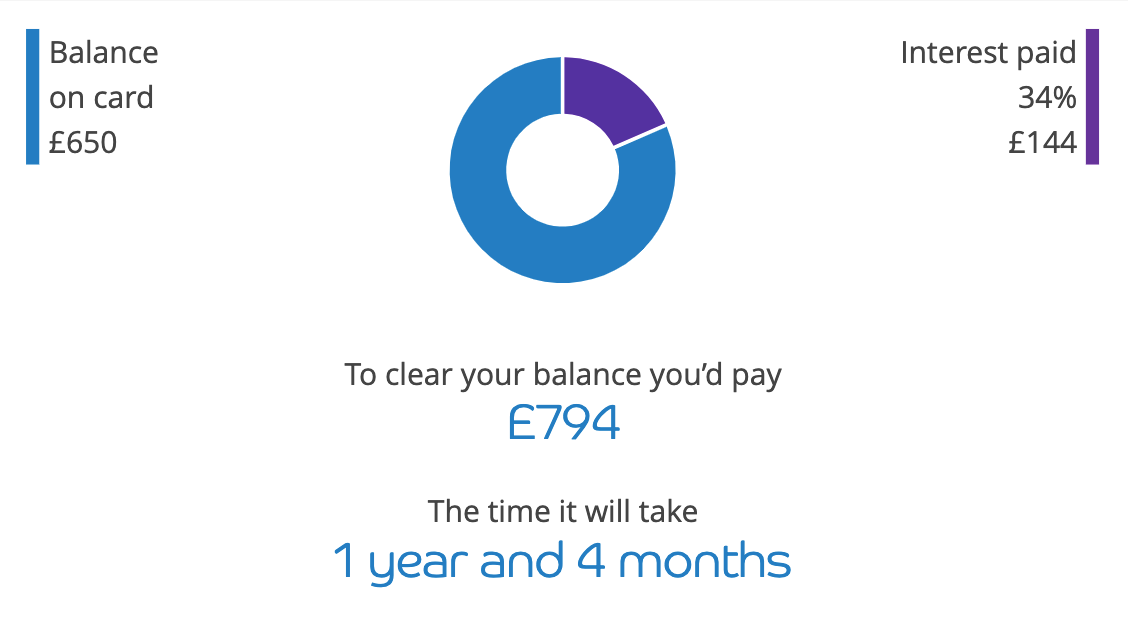

However, the average credit card charges 34% interest if you don’t pay the balance off in the full. If you decided to pay £50 a month towards the credit card balance, you would end up paying an extra £144. This means the original car bill of £650 now costs £794.

It would also take over 1 year to pay off the credit card debt and with the way life goes it’s likely another unexpected expense would appear in this period of time.

Not being able to pay for an unexpected expense means the next one gets compounded on top of it and then that debt compounds. Compound interest is a great thing when it’s working for you, but is a terrible thing when working against you. This can leave you in an endless cycle of paying off debt.

This is why it is so important to take action now to stop a situation like this happening and start an emergency fund.

I like to view an emergency fund as the oxygen that allows us to get on and enjoy our lives knowing we will always have something to breath when times get tough.

How much do I need in my emergency fund?

I believe the ultimate goal is to have three to six months worth of bills saved in an emergency fund.

However, this is dependant on what kind of industry you work in. If it’s relatively easy to find a new job then three months of bills in an emergency fund might be good for you as it would give you time to pick your next role rather than rushing.

If you work in a specialised industry or are self-employed then having a larger emergency fund with 3+ months of bills may be better to support you as it might take longer to find work.

If you’re unsure how much your bills are each month then a good way is opening up your banking app and look at all your outgoings from last month. Take a look at all the Direct Debits that came out of your account each month and any other recurring payments. Note all these down and add them up.

Some banking apps even do this for you. This will give you a total of your monthly bills. Then it’s a case of multiplying that number by three, or whatever number you feel is comfortable, and set that as your goal.

If you’re a long way off having saved three months worth of bills please don’t feel put off and think it’s pointless. Making a start is the most important thing you can do for yourself and anyone you support financially. Even with just £100 you would be able to pay for a new tyre.

Where to keep my emergency fund?

Most importantly, your emergency fund needs to be accessible. Without quick access it won’t be able to fulfil its purpose as we never know when the next unexpected expense is coming. This is why I like to keep my mine in a cash savings account so I can easily transfer to and from it with my banking app whilst still earning interest.

A great tip that helps stop me spending my emergency fund is setting up a separate savings account or savings pot dedicated solely to an emergency fund and automate money going into it via standing order. This helps to visualise and separate it from any other money in your bank account. It also means, once you set up a standing order, whatever amount you contribute to building an emergency fund will happen automatically.

Thanks for reading! If you don’t have one already, I hope I’ve made you think about the importance of starting an emergency fund even with just a small amount. Let me know whether you’ve already got an emergency fund or are thinking about start one in the poll below!

Link to the Stocks & Shares ISA providers I use:

Trading 212 ISA. You can use my link below and we both will receive a share worth up to £100 once you deposit money in your account. https://www.trading212.com/invite/16ZqwMii18

Vanguard UK. https://www.vanguardinvestor.co.uk/